- Our customers have been hired by : *Foot Note

Every accountancy role, from auditor to bookkeeper to management accountant, has unique requirements. Learn how to create a professional CV that effectively showcases your expertise, highlights your experience with the right phrases, and maintains a clean, clear format. Explore our CV examples from the UK job market to ensure your application demonstrates commitment and attention to detail – essential qualities for success in accountancy.

SEARCH ALL CV EXAMPLES

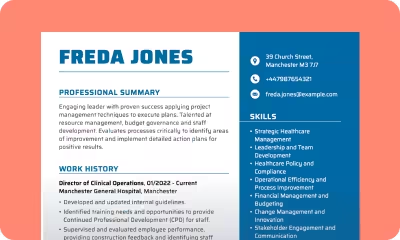

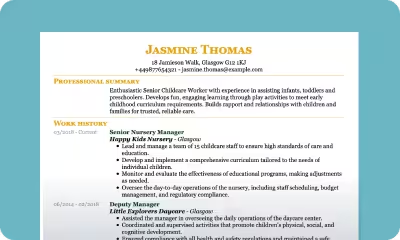

Accounting CV templates by work experience

Accounting CVs can differ significantly based on seniority level and experience, reflecting the progression in responsibilities, skills, and accomplishments over the course of an accountant’s career. As accountants advance from entry-level to senior roles, their CV templates evolve to emphasise increasingly strategic and managerial capabilities, underscoring their readiness to handle higher levels of accountability and decision-making within an organisation.

Accounting CV template with no experience

Candidates for entry-level positions in the accounting industry are usually recent graduates or people moving into accounting from other fields.

When writing an Accounting CV without experience, focus primarily on:

- Education: This section should detail degrees in accounting or related fields and any relevant courses or special projects that demonstrate a basic knowledge of accounting principles.

- Internships and volunteer experience: These positions are essential on an entry-level CV, as they often represent a candidate’s only real accounting experience. It is important to focus on the tasks performed and skills developed.

- Certifications and skills: Beginning accountants are encouraged to highlight any initial certifications or basic computer skills, such as proficiency in Microsoft Excel, QuickBooks or other accounting software.

- Soft skills and achievements: Qualities such as attention to detail, analytical skills and teamwork are key. It is also beneficial to include any academic or extracurricular achievements that demonstrate leadership or collaboration skills.

Accounting CV template for mid-career level

A mid-career accounting CV should clearly illustrate professional growth and increasing responsibilities, structured around key points:

- Job achievements: Highlight significant contributions in financial management, project leadership, and compliance.

- Advanced qualifications: Emphasise certifications such as Chartered Accountant (CA) or Certified Public Accountant (CPA).

- Software proficiency: Demonstrate expertise in relevant accounting software, enhancing operational efficiency.

- Quantifiable achievements: Specify the tangible impact of your work, showcasing efficiencies created, costs reduced, and revenue generated.

- Leadership experience: Detail experience in mentoring staff or leading project teams, underlining management capabilities.

Accounting CV template for senior level

An accounting CV for those at a senior career level or in managerial positions should be carefully structured to highlight expertise, leadership, and strategic impact:

- Leadership and management experience: Outline your experience in leading teams, running departments, or managing big projects and financial tasks. Make sure to mention how many people you’ve led, the size and type of projects you’ve managed, and any major changes or decisions you were responsible for.

- Strategic contributions: Stress your role in shaping the company’s financial plans. This might involve setting up new accounting systems, creating rules for compliance, or being a part of the team that makes big company decisions. These details show how you can play a key part in guiding the company’s strategy.

- Advanced certifications and specialisations: Point out any high-level qualifications, such as being a Chartered Accountant or having special knowledge in areas like forensic accounting or financial analysis. These prove your deep understanding and ongoing commitment to learning in your field.

- Professional affiliations and industry influence: Mention if you’re a member of any well-known accounting groups, take part in industry conferences, or have written articles for professional magazines. This shows you’re actively involved in the wider accounting community.

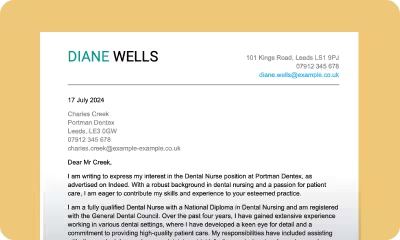

- Professional CV format: While your extensive experience might suggest a lengthy CV, it’s crucial to keep it concise – ideally no more than two pages. Focus on your most recent three jobs, but don’t forget to mention your total years of experience in the Professional Summary and Cover Letter. This helps to keep your CV clear and straightforward without skipping the important information.

Take a look at our extensive library of CV templates to find inspiration for your own job application.

It only takes

MINUTES for an average MyPerfectCV user to create a CV

Create Your Accounting CV in 3 Simple Steps

- Fill in a quick and easy form

- Tailor the CV to your liking

- Download and apply

*The names and logos of the companies referred to above are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with myperfectCV.