- Our customers have been hired by : *Foot Note

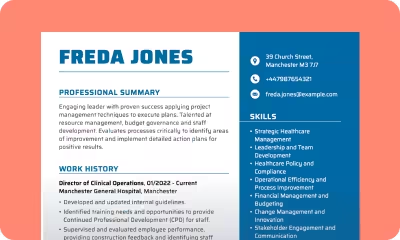

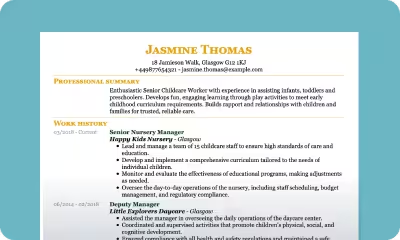

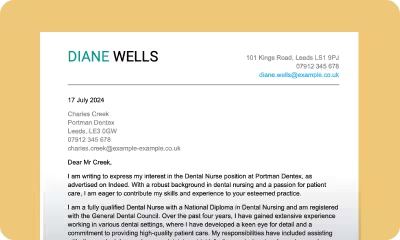

A credit controller is an essential figure in large business finance departments—keeping costs low and profits high. Managing and controlling the company’s credit requires a mix of organisational, finance, and accountancy skills. Discover how credit controllers prove their valuable skills to recruiters with our professional CV templates.

Kick off by editing this Credit Controller CV template, or browse our assortment of the best CV templates to find one that aligns with your preferences.

SEARCH ALL CV EXAMPLES

Control your career with our top tips for writing your credit controller CV

Show your numerical skills

A great credit controller needs a strong head for numbers. Show recruiters, you have what it takes by including impressive metrics on your CV. Whether you lowered operational costs by 12% or slashed the number of late payments in half, these achievements will help your application stand out from the crowd – and show off your memory for facts and figures.

Proofread, proofread, proofread

The tiniest mistake in a credit check or customer account can cause serious trouble—attention to detail is crucial. By proofreading your CV, you can make sure your application is error-free – helping to demonstrate your careful approach to work.

Include your hard and soft skills

Credit controllers deal with complex financial matters every day – but they also deal with real people, often under challenging circumstances. Always include a skills section to outline your hard and soft skills. Your skills section will show that you have the right combination of personal and professional qualities to succeed in a role.

Common skills for your credit controller CV

- Numeracy

- Analytical skills

- Accounting software

- Strong communication (written and verbal)

- Research skills

- Knowledge of financial law and compliance

Extra skills that will make you stand out

- Negotiation

- Customer service

- Tact and sensitivity

- Ability to keep calm under pressure

- Assertiveness

- Impeccable record-keeping

Top FAQs for your credit controller CV

How do I become a successful credit controller?

To become a successful credit controller with a great CV, you will need the relevant qualifications. Whether it’s a degree in Economics or a college diploma in Accounting, this experience will show recruiters that you have solid credit knowledge.

What are a credit controller’s duties?

A credit controller is responsible for carrying out credit checks, for example, on new customers or those applying for a particular loan or financial product. The task involves identifying potential problems such as outstanding debt or poor credit history. They may also be responsible for managing invoices, collecting debt payments, and reconciling accounts.

What skills do you need to be a credit controller?

Some of the most critical skills for a credit controller include strong numeracy and communication. Fluency in numeracy will help in explaining sensitive financial matters, often to people with little credit knowledge. You will also need to be analytical with the ability to carry out in-depth research.

Build a credit controller CV that will never leave you shortchanged

To take the next step in your credit controller career, you’ll need a professional CV. With myPerfectCV’s proven CV builder tool, you can create an application that’s sure to do you credit. Our templates, tailored content, and top tips are designed to help you personalise your perfect CV. It’s quick and easy – so why not check it out today?

*The names and logos of the companies referred to above are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with myperfectCV.