- Our customers have been hired by : *Foot Note

A credit manager CV illustrates your qualifications, skills, and achievements in similar roles in a neat format. It also delves into your suitability for the position by quantifying your previous successes. We know what you’re thinking – that’s easier said than done. But luckily, we have plenty of valuable online resources to simplify the process.

Need more content and design inspiration? Find out how to illustrate your skills and experience with CV examples for professional credit managers. Each professional document explains what information to include and how to present it in the best possible light. Plus, we share a bank full of helpful tips and tricks to keep you on the right track. Landing your dream job is easy when you enlist the right support.

Even better, the following guide breaks down the CV writing process step by step, so you don’t have to worry about forgetting key sections.

Ready to invest in your success? Keep reading as we cover:

SEARCH ALL CV EXAMPLES

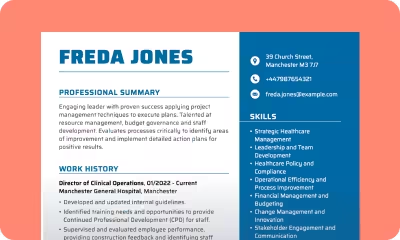

Sample credit manager CV

Therese Hartington

39 Church Street

Bristol M3 7J7

+44 987654321

Therese.Hartington@example.co.uk

Professional summary

Detail-orientated Credit Manager skilled at analysing lending activities according to current regulations, standards and market conditions. Offering 6 years of financial experience in the banking industry.

Work history

January 2022 – Current

City Banking – Bristol

Credit Manager

- Wrote and implemented standard operating procedures for credit personnel to ensure consistency in unit operations.

- Optimised credit approval and collection processes, improving operational efficiencies by over 20%.

- Provided resources and expertise for conversion, validation and training required for company-wide software updates.

- Collected data and performed trend and variance analysis to mitigate risk arising from bad debt.

September 2017 – December 2021

Bank of England – Manchester

Assistant Credit Manager

- Wrote reports outlining project progress and results.

- Increased customer satisfaction by resolving issues.

- Engaged with stakeholders to build relationships and brand awareness.

- Assisted with infection control through social distancing and PPE wearing.

Skills

- Credit Analysis

- Risk Management

- Loan Underwriting

- Financial Statement Analysis

- Client Relationship Management

- Credit Risk Assessment

- Loan Documentation

- Compliance Management

Education

December 2016

University of London London

Master of Business Administration Finance

December 2014

University of Manchester Manchester

Bachelor of Business Administration Finance

What is the best format for your credit manager CV?

Something we get asked all the time is – how can I make an excellent first impression without meeting the employer face to face? Simply choose between popular CV formats that organise your content with clear sections, headings, and bullet point lists. These professional layouts help hiring managers and applicant tracking system (ATS) software make sense of your content.

While there are hundreds of styles out there, two stand out as recruiter favourites – the reverse-chronological CV and the skills-based CV. The former outlines your employment background, starting from your current or most recent role. The latter highlights relevant transferable skills, such as “analytical thinking”, “problem-solving”, and “report writing”.

So, which CV format is best for a credit manager? We recommend using the reverse-chronological format because employers prefer applicants with tangible experience. This structure makes it easier for the reader to draw parallels between your previous jobs and the one you’re applying for. Skills-based CVs are usually only appropriate for entry-level positions.

What else do you need to know? Here are a few extra tips for CV writing.

- Your CV shouldn’t exceed two pages of A4

- Use a recruiter-approved font like Helvetica, Arial, or Calibri

- Keep the overall tone friendly, formal, and polite

- Unless applying for a creative role, keep it simple – there’s no need for colours, images, and funky typefaces

- Send your CV as a Word or PDF file unless asked otherwise

How to write a CV for a credit manager

Now you’ve chosen a format, let’s explore how to write a CV for a credit manager. The following sections explain everything you need to know, from penning a persuasive personal statement to outlining your highest qualifications. Towards the end, we’ll also answer some of your most common CV writing FAQs.

Here’s what’s on the agenda:

- How to add contact details to your credit manager CV

- How to write a personal statement for your credit manager CV

- How to present your work history on a credit manager CV

- Top skills for your credit manager CV

- How to add education to your credit manager CV

How to add contact details to your credit manager CV

If you’ve sent dozens of applications but haven’t heard back, you might have missed an obvious detail – adding your contact details at the top of the page. Employers don’t have time to track you down, so it’s the only way they can reach you about the next steps. We suggest highlighting this information in a slightly larger or bolder font for maximum readability. Remember to include:

- Full name – first name and surname

- Location – mention if you’re willing to relocate

- Phone number – the best one to reach you on

- Email address – keep it professional

Example of contact section for a credit manager CV

Anthony O’Brien,

88 Boroughbridge Road,

Birmingham, B28SP,

07912345678,

obrien.a@example-example.co.uk

How to write a personal statement for your credit manager CV

The first thing someone sees when reading your CV is the personal statement. This punchy three to four-sentence introduction outlines your most valuable experience, skills, and qualifications to convince the hiring manager to read more. Of course, squeezing everything into such a tight word count can be tricky, which is where the formula below can help.

Sentence one introduces who you are, including your years of experience, career focus, and place of work, such as “credit manager with two years of experience in the power industry”. Sentence two explains what you can achieve, backed by facts and figures. For example, you might have “managed a ledger of up to 450 client accounts”. Finally, sentences three and four reiterate your unique skills, such as “client portals” and “e-billing”.

What else do you need to know? Here are a few more pointers to make your personal statement as powerful as it can be:

- Write in the third person to sound more professional

- Stick to the sentence limit – up to 100 words is ideal

- Use positive descriptors like “trustworthy” and “diligent”

- Tailor all information to the job specification, avoiding generalisations and clichés

- Discuss what you can bring to the table – save career ambitions for the cover letter

Example of personal statement for a credit manager CV

Talented credit manager of ten years, adept in supporting financial needs and administering credit accurately and effectively. Introduced a new banking system that boosted productivity by 43%. Possessing top strengths in data analysis, time management, and verbal and written communication, improving overall productivity in loan processes.

OR

Diligent credit manager with three years of experience in the financial sector. Oversaw risk analysis for the firm, saving an estimated £2,500,000 in costs. Confident with credit underwriting, exposure control, collections, and reporting activities. Strong Excel and numerical skills.

How to present your work history on a credit manager CV

Here’s the million-dollar question when it comes to securing your dream job – do you have the right work experience? Employers don’t care about fancy business jargon and out-of-date qualifications – they simply want to know whether you can hit the ground running. Start from your current or most recent role and work your way back, listing between three to six responsibilities for each.

Above all else, ensure all information is recent and relevant. There’s no point discussing your credit manager job from twenty years ago if you’ve been out of the industry since. Similarly, the hiring manager probably won’t be interested in last summer’s waitressing job. Always link back to the role you’re applying for to keep yourself from straying off-topic.

How should you format this section? Include the following information:

- Job title

- Company name

- Company location

- Employment start and end dates

- List of responsibilities

- Achievements, awards, and promotions

Like the personal statement, remember to sprinkle in plenty of statistics. Let’s say you “monitored accounts for signs of fraud” – can you expand on this? Perhaps you “monitored 100 accounts for signs of fraud”. Or, you could provide the outcome, such as “monitored accounts for signs of fraud, saving the company £300,000 in legal fees”. The more specific you can be, the more impressive you’ll sound.

Lastly, convey confidence by using positive adjectives and action verbs. The former describes your personality, which is important because employers want to know whether you’d be a good cultural fit. For instance, you might be “loyal”, “helpful”, and “organised”. The latter are brilliant alternatives to “responsible for”. Some of our favourites for credit controllers include “analysed”, “acquired”, and “measured”.

Example of work experience for a credit manager CV

Credit manager | Troy Financial Services, Birmingham | July 2021 – present

- Monitoring accounts for signs of fraud and non-payment issues for swift resolution.

- Attending ongoing professional training to facilitate accurate and productive credit management.

- Utilising a deep understanding of industry best practices and legal requirements to prevent critical incidents.

- Providing resources and expertise for conversion, validation, and training required for company-wide software updates.

- Maintaining full knowledge of the current regulatory environment and proactively adjusting to meet changing requirements.

Credit officer | Smith & Jones Lenders, Birmingham | October 2018 – June 2021

- Compiled database of loan applicants’ credit histories, corporate financial statements, and other financial information.

- Submitted personal loan applications to an underwriter for verification and recommendations, maximising approvals.

- Successfully closed an average of 15 loans per month.

- Created reports on determining trends and fiscal year-end losses within each quarter.

- Reviewed over 15 financial statements per quarter, ensuring up-to-date knowledge.

Junior credit analyst | Smith & Jones Lenders, Birmingham | August 2016- October 2018

- Conducted presentations to upper management and executive teams for loan recommendations.

- Performed credit reviews on local corporations to assess financial conditions.

- Developed an understanding of financial statements through evaluation, aiding improved future risk assessments.

- Analysed customer data such as financial statements to determine the level of risk involved in extending credit.

- Regularly reviewed customer files to ensure the sound condition of receivables.

Top skills for your credit manager CV

While they might seem redundant after outlining your work experience, it’s important to group together your best CV skills. Why? Hiring managers use this section to determine whether you meet the job criteria. Plus, ATS software prefers applications with plenty of scannable keywords and phrases. We advise noting up to 12 skills, split equally between technical hard skills and transferable soft skills.

What’s the difference? Hard skills are specialised and learnt through education or on the job. Examples include “risk analysis”, “underwriting”, and “running accurate credit checks”. On the other hand, soft skills reveal more of your character, and people have a natural inclination towards them – think “organised“, “communicative“, and “creative”.

Our top advice is to balance both fairly. Experience doesn’t compensate for a bad attitude, but being pleasant isn’t enough without the practical tools to get the job done. If you’re stuck for ideas about what skills to include, check out the below lists:

Essential skills for a credit manager

- Commercial awareness

- Time management

- Budgeting

- Documentation and bookkeeping

- Teamwork

Desirable aptitudes to set you apart

- Numeracy

- Relationship-building

- Analysis

- Compliance with the FCA

- Strong communication

How to add education to your credit manager CV

Education often sets you apart when you’re competing against equally skilled and experienced candidates. You can discuss school, college, and university courses, extracurricular training, special licences, and memberships to governing bodies. Basically, summarise all your professional development to reassure the reader that you have the brains to surpass expectations.

This section is simple to complete, but there are a few rules to remember. Like work experience, make sure everything you include is recent and relevant. Otherwise, you’ll waste space on qualifications that don’t strengthen your application, like GCSEs from three decades ago. Plus, there’s no need to include grades unless specifically asked, so leave out anything that might put doubts in the employer’s mind.

How do you become a credit manager? Most organisations prefer candidates with a degree in a related subject, such as “Business”, “Finance”, “Accounting”, or “Business and Management”. Once you’ve completed your studies, search for companies that offer graduate training schemes to cement your knowledge.

Here’s a list of details to include in this section:

- Name of school, college, university, or other awarding body

- Study start and end dates

- Subject title

- Qualification level – e.g. A levels or undergraduate degree

- Qualification result – not essential but desirable

Example of education for a credit manager CV

Birmingham University | September 2020 – July 2023

Accounting (Bachelor of Science): First-class honours

Southbrook Secondary School, Birmingham | September 2018 – July 2020

3 A levels: Maths (A), Economics (B), and Business Studies (B)

Your credit manager CV questions answered

What are the roles and responsibilities of a credit manager?

While every position looks different depending on the industry, all credit managers oversee a company’s financial policies. This usually involves:

- Running accurate credit checks and providing credit limits

- Assessing payment performance

- Making decisions within credit policies and procedures guidelines

- Mitigating financial risks and improving cash flow management

- Liaising with other departments

What skills does a credit manager need?

To become a credit manager, you will need to demonstrate a high financial awareness level. You will need a thorough knowledge of credit regulations, as outlined by the Financial Conduct Authority, and the ability to carry out in-depth research into customers with speed and sensitivity.

Is a credit manager a stressful job?

All jobs have their highs and lows, so being a credit manager isn’t necessarily more stressful than any other. However, it involves a lot of decision-making and problem-solving, which might overwhelm people fresh out of university who haven’t had much experience in the workplace. We suggest sharpening these skills on the job by seeking out mentors and training courses.

How much does a credit manager make?

As it’s a senior position, the average salary for a UK credit manager is £46,616 per annum (base pay). Salary will depend on your workplace. If you work for a large business such as a national bank, this figure could rise to over £70,000 per annum.

Build a strong credit manager CV that won’t blow your budget

At myPerfectCV, we understand that a professional CV is crucial if you want to take the next step in your credit manager career. That’s why our tried & tested CV builder, CV examples, and CV templates make it quick and easy for you to get started.

Discover our credit manager job description templates, top recruiter tips, and drag-and-drop content to make yours today.

*The names and logos of the companies referred to above are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with myperfectCV.