- Our customers have been hired by : *Foot Note

KYC analysts are rare, being one type of hard worker among many in the accounting field. KYC analysts have many responsibilities, meaning their employer must be convinced of their skills and have that impression constantly reaffirmed with results. At the same time, a KYC analyst position can be highly desirable, and a strong CV will ensure that you are more likely among your peers to get the job.

If you’re entering the accounting field, you may want to look closely at our KYC analyst CV sample below. Even if you already have a wealth of experience and a completed CV, it may be worth looking over one of our CV examples to improve your presentation.

On top of this, we recommend choosing a pre-made CV template to format your information. There are countless professional designs to browse to simplify the writing process. Pick a layout that best suits your preferences, fill in the blanks using the following tips, and save the final document as a Word or PDF file. Who said CV writing had to be stressful?

Now you have all the tools, let’s run through:

SEARCH ALL CV EXAMPLES

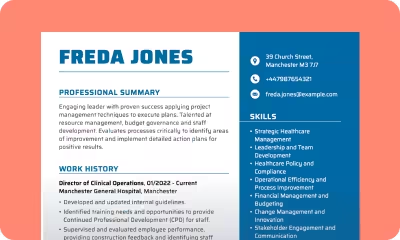

Sample KYC analyst CV

Joanna Dylan

246A Lawrence Drive

Bradford BD7 4PP

07912345678

Joanna.Dylan@example-example.co.uk

Professional summary

Professional Analyst with a background in banking and financial services. Skilled in reviewing and verifying customer identification documents and other information to verify completeness and accuracy. Successfully manages relationships across different businesses and functions.

Work history

December 2020 – Current

Maple Banking – Bradford

KYC Analyst

- Modelled financial information related to payroll, capital projects and operating supplies.

- Built and updated financial models to support ongoing budgeting and forecasting processes, analyse complex information and process real-time data.

- Maintained complete and accurate financial records following optimal accounting principles.

- Compiled and assessed investment pricing, yield and expected changes.

February 2016 – November 2020

E. I. Banking – Bradford

KYC Specialist

- Generated invoices based on established accounts receivable schedules and terms.

- Completed reviews of personal or business records in cases of insolvency and bankruptcy.

- Analysed budgets and financial projections for accurate reporting of company performance.

- Helped resolve disputed claims as an official client representative to tax officials.

Skills

- High-risk account reviews

- Experienced with database software

- Excellent Communication

- Analytical and Critical Thinking

- KYC regulations

- Problem-Solving

Education

2015

University of London London

Master of Accountancy

Choosing the right format for your KYC analyst CV

We know CV writing is exciting and you want to dive into the details, but wait a minute – the first step is choosing between popular CV formats. Structuring your information correctly is the easiest way to impress employers. However, many candidates skip over this step and submit messy applications that only end up in the bin. Ouch!

There are two widely accepted options in the UK – the reverse-chronological CV and the skills-based CV. The former outlines your work history, starting from your current or most recent role. You can discuss internships, temporary contracts, and part-time positions alongside full-time employment. The latter focuses on transferable skills, such as “problem-solving”, “critical thinking”, and “leadership”.

So, which layout is best for KYC analysts? Unsurprisingly, the reverse-chronological CV cinches the top spot. Employers will only consider applicants with tangible experience and proven results because the position is high-stakes. Usually, a skills-based CV is only suitable for people with minimal or no relevant work experience.

As well as choosing the most suitable format to spotlight your skills, experience, and qualifications, here are some extra tips to keep in mind:

- Your CV should be one to two pages long maximum

- Use a professional font like “Arial” or “Times New Roman”

- Improve readability with bullet points, headings, and sections

- Don’t be fancy – there’s no need for images or colours

- Send your CV as a Word or PDF file unless asked otherwise

How to write a CV for a KYC analyst

Understanding how to write a CV is easy when you break it down into digestible chunks. The following sections cover everything you need to know about CV writing, including the best ways to present your work history, skills, and qualifications. What’s more, we’ll answer some of the most frequently asked KYC analyst CV questions. Keep reading as we cover:

- How to add contact details to your KYC analyst CV

- How to write a personal statement for your KYC analyst CV

- How to present your work history on a KYC analyst CV

- Top skills for your KYC analyst CV

- How to add education to your KYC analyst CV

How to add contact details to your KYC analyst CV

Adding up-to-date contact details at the top of your CV is so obvious it’s easy to forget. We suggest highlighting your information in a slightly larger or bolder font to catch the recruiter’s attention. Our top advice? Keep your email address work appropriate – nobody wants to hire “surferboi924@gmail.com”. Remember to include:

- Full name

- Location

- Phone number

- Email address

Example of contact section for a KYC analyst CV

Jim Biselli,

602 Clandon Park,

Mount Pearl,

Newfoundland, NS92 3HD

709-391-8301,

jimbiselli@example.com

How to write a personal statement for your KYC analyst CV

Want to impress the employer? You need a punchy and persuasive personal statement that summarises your top talents, achievements, and qualifications. However, you only have three to four sentences to squeeze everything in, which is tricky for the most experienced CV writers. Luckily, we have a winning formula that ditches the waffle.

Open with who you are, including your career focus and years of experience. Next, cement your expertise with a statistic. For instance, you might have “investigated and resolved compliance issues, saving the company over £250,000”. The more specific you can be, the more you’ll stand out. Tie everything together with your unique skills and specialisms, such as “Canadian financial law” or “non-governmental organisations and charities”.

Above all else, don’t copy what you read online. Think about the things that make you special and lead with authenticity – hiring managers don’t appreciate exaggeration or embellishment. Other tips include:

- Write in the third person to sound more professional

- Use plenty of positive adjectives like “confident” and “hardworking”

- Tailor all the information to the job advertisement

- Substantiate your skills with evidence but keep it brief

- Stick to the word count – no more than 100 words

Example of personal statement for a KYC analyst CV

A thorough and meticulous KYC analyst with over 20 years of experience. Confident in risk identification and reduction, saving international banks hundreds of thousands of pounds in losses. Knowledgeable about compliance monitoring, CRM systems, and banking trends.

OR

A passionate KYC analyst with over five years of experience. Excellent understanding of financial crime and regulations. Able to identify unusual customer behaviours and trends with keen attention to detail. Regularly assist clients with updating their information and opening brand-new accounts.

How to present your work history on a KYC analyst CV

The work history section is one of the most exciting for recruiters because it gives them an insight into your strengths. Plus, they can determine how long you typically stay with a company and whether there are any gaps in your career history (these need to be explained in your cover letter or interview).

We recommend including as many different duties as possible to demonstrate the scope of your abilities. Spend a reasonable amount of time outlining the following:

- Job title

- Employment start and end dates

- Company name

- Company location

- Brief list of responsibilities

- Career achievements, such as promotions or awards

Like the personal statement, give weight to your skills by including results, facts, and figures. Let’s say you “performed interviews and background checks on individuals” – can you note how many or explain the outcome? Hopeful KYC analysts must back up their claims because it’s a highly competitive field, and anything less than exceptional won’t be considered!

There’s nothing worse than a regurgitated CV that sounds the same as everyone else’s. As such, don’t bother with obvious tasks like “administration” and “using Microsoft programmes”. Instead, stress the technical knowledge and practical tools that make you the best person for the job.

Lastly, keep the tone upbeat with positive adjectives and rousing action verbs. You might be “disciplined”, “organised”, and “dependable”. Some of our favourite action verbs include “modernised”, “remodelled”, and “mentored”. These powerful words convey confidence and reassure the hiring manager that you have the qualities to succeed.

Example of work experience for a KYC analyst CV

KYC Analyst | Maple Banking | Manchester (November 2019 – date)

- Performing interviews and background checks on individuals.

- Organising massive amounts of entity data, such as legal names and addresses during routine checks.

- Examining wire activity of non-individual entities for foreign shell corporations and terrorist financing.

- Enhancing due diligence on all entities via Lexis-Nexis, World Check, Dun & Bradstreet, and additional internal and external sources.

Loan Officer | Maple Banking | Manchester (August 2014 – September 2019)

- Received valuable on-the-job training in accounting and KYC principles.

- Interviewed and researched individual clients for loan eligibility.

- Worked with an existing international business client in the medical field to improve the client’s line of credit within the bank’s protocol.

Top skills for your KYC analyst CV

A dazzling collection of CV skills is the cherry on top of a KYC analyst CV. It’s a chance to recap your most sought-after qualities in an easy-to-read and scannable format. Many recruiters head to this section first to check whether you possess the fundamental tools to hit the ground running. We suggest including up to 12 skills, split between hard and soft skills.

What’s the difference? Hard skills are technical and learnt on the job or via formal education – think “reviewing customer documentation”, “overseeing account onboarding processes”, and “liaising with the Financial Service Ombudsman”. In contrast, soft skills are transferable and intrinsic, such as “goal-oriented”, “adaptable”, and “motivational”.

It’s essential to blend both when trying to secure an interview. You must demonstrate your practical knowledge while convincing the employer that you’d be a good fit for the organisation and team. Need some more inspiration? Take a look at the following lists:

Essential skills for a KYC analyst

- Confident in fast-paced and high-pressure environments

- Excellent attention to detail

- Advanced knowledge of financial crime

- Experience onboarding corporate accounts

- Knowledgeable about compliance issues

Desirable aptitudes to set you apart

- Highly accountable and responsible with a strong ethical code

- Able to meet deadlines without compromising security standards

- Highly logical and unbiased in entity data analysis

- Comfortable working in a team environment

- Multilingual

How to add education to your KYC analyst CV

Education underpins work experience and is especially significant for KYC analysts. Employers actively search for degree-educated candidates with a treasure chest of practical knowledge and impressive qualifications – paired with a passion for learning and development. You can discuss extracurricular training and certificates alongside school, college, and university courses.

What does it take to become a KYC analyst? At the very least, you’ll need a Bachelor’s degree in a relevant field, such as “Economics” or “Law”. Larger banks might also require a Master’s degree in “Finance” or “Banking”. Not only do qualifications confirm your credentials, but KYC analysing is a niche field, and you’ll make plenty of valuable connections throughout your studies via placements and internships.

When outlining your qualifications, include:

- Name of school, college, university, or other awarding body

- Study start and end dates

- Subject title

- Qualification level – e.g. Bachelor’s degree or Master’s degree

- Qualification result

Example of education for a KYC analyst CV

Lord Orlando University, St. John’s, Newfoundland (October 2010 – October 2014)

Master of Accountancy: First-class honours

Lord Orlando University, St. John’s, Newfoundland (October 2010 – October 2014)

Master of Accountancy: First-class honours

Lord Orlando University, St. John’s, Newfoundland (July 2000 – July 2004)

Bachelor of Political Sciences: 2:1

Top dos and don’ts for KYC analyst CV writing

Do

DO mention your areas of expertise

KYC analysts cover many specialisms and industries, so we suggest mentioning your areas of expertise in your personal statement and cover letter. You might deal exclusively with Canadian financial law or complex client segments like trust providers and charities. Outlining your niche will help recruiters send your CV to the best people.

DO spotlight your technical knowledge

You need a wealth of technical knowledge and tools to excel in this role, and hiring managers will scan your KYC analyst CV for specific skills. Our top advice is to re-read the job advertisement. Don’t lift text straight from the spec, but identify what the company is looking for and use this to inform your CV skills section.

Don’t

DON’T forget your cover letter

Attaching a thoughtful cover letter is one way to make an excellent first impression. This short one-page document should introduce who you are, emphasise why you’re the perfect candidate, and express your enthusiasm for the role. It’s also a great place to explain any gaps in your employment history and note your availability for an interview.

DON’T send your CV without spell-checking

KYC analysts must be sticklers for detail, so you don’t want to send a CV riddled with errors. Spell-check your application and ask a trusted person to give you feedback. Fresh eyes can often pick out repetitiveness and hidden mistakes!

Your KYC analyst CV questions answered

What does a KYC analyst do?

KYC analysts have many responsibilities, from onboarding new accounts and evaluating risk to studying market trends and customer behaviour patterns. Every day presents new and exciting challenges, so you’ll never get bored. While tasks vary depending on the industry and niche, some of the key crossovers include:

- Setting up new corporate accounts

- Investigating compliance issues

- Monitoring transactions and flagging unusual activity

- Risk identification and reduction

- Studying trends to improve marketing strategies, product development, and customer satisfaction

What skills do you need to be a KYC analyst?

The most successful KYC analysts have the right knowledge and personality to handle jam-packed workdays. They have a knack for problem-solving, even under pressure, and a comprehensive understanding of financial law. Some of the skills employers look for include:

- Proactive and able to use initiative

- Meticulous attention to detail

- Logical and structured approach

- Ability to work under pressure and to fixed deadlines

- Confident in handling multiple projects

What are KYC analyst interview questions?

Congratulations! You’ve made it to the interview stage, and now it’s time to prepare. The interview will be just as detailed as the CV writing process, so expect to be put through your paces. Some of the most common questions applicants get asked include:

- How will you identify suspicious transactions?

- What software do you have experience with?

- Describe how you overcame a problem in the workplace

- What is a KYC policy?

- Why should we choose you for the position?

What is the average salary for a KYC analyst?

It’s difficult to say how much KYC analysts earn because it depends on multiple factors, including location, experience, and company size. However, the average salary in the UK is around £45,000. However, it’s not unusual for senior analysts to earn upwards of £55,000.

Create a compelling KYC analyst CV today

This KYC analyst CV sample is just one of many examples you could use to help your job search. Plus, similar CVs may give you an idea of what else to do, and our own CV builder may also help.

Read through our CV examples to better understand content and design, and then use our pre-made CV templates to present your information in the best possible light. There’s a design suitable for all KYC analyst roles, along with great content tailored to your duties and skills.

*The names and logos of the companies referred to above are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with myperfectCV.